--------------------------------------------------------------------------------------------------------------------

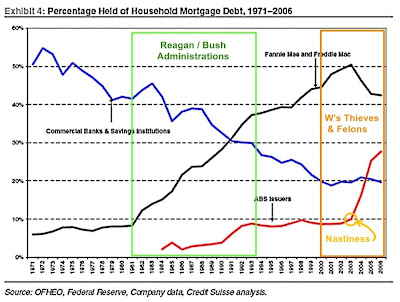

Let's be real clear here. Reagan (and Bush I) expicitly and enthusiastically embraced financial socialism in the housing market to boost a lagging economy. Only under their administrations, the mortgage giveaway was exclusively aimed at the middle class. In 1992, the Democrats were just finally saying so long as you're giving away government largess, how about at least spread it marginally wider. Their intentions were good, and in fact the Clinton Administration put breaks on the whole affair in its first term, though loosened up in their second while under siege.

But the party really only hit high-gear after Senator Phil Gramm killed Glass-Steagal's Depression-era firewalls. And once the hyennas in W's administration got in office, they further greased the tracks of the runaway train by crippling much of the remaining oversight and enforcement. They deliberately did nothing to stop it because they realized the housing market 'bubble' was the only thing that could prop up their long-planned war in Iraq.

Note in particular, the rise of Asset Backed Securities (ABS) issues coincides with the war; just in time to prop up the economy as it started to correct itself in the face of that crisis. Oh, and it wasn't just mortgages - those ABS issues also comprised the Student Loan Crisis which saw a parallel frenzy of fraud as the banking community figured they could roll those loans into the ABS mix along with autos and credit card debt. Essentially, all forms of our common debt were rolled into the MBS/ABS slice-and-dicer to feed a very large and all encompassing Ponzi scheme built on 'vanishing' risk.

In fact, if your read the details of the 'technical analysis' currently all the rage in the financial sector today, it all revolves around the fact that all our debt was sliced-and-diced so finely and repeatedly that it is now largely impossible by almost any means for the ABS holders to trace those instruments back to individual houses, automobiles, students, and cardholders - the whole debt market effectively acted as a massive money laundering operation the scale and scope of which the Mafia could only have wet dreams about.

A good friend, who in the late 80s got his Ph.D. in Accounting (Auditing / Regulatory Oversight), summed it all up succinctly:

"Corporations, absent appropriate regulatory oversight, are indistinguishable from organized crime."

He said it was pretty obvious from the go-go, junk-bond 80's where this was all headed. He noted that that same crowd mounted sustained and continuous attacks against government oversight from the 90's on once the 'easy money' and lootable piles of unprotected cash of the 80's dried up and they were all faced with the prospect of actually having to go back to [honest] work.

So, while there is plenty of blame to go around, make no mistake about it - this was all a socialist party thrown by Republicans and then crashed at the eleventh hour by financial felons in the banking industry and the hooligans on Wall Street...

No comments:

Post a Comment